Hedging Futures

Hedging Futures: A Comprehensive Guide to Managing Risk in Financial Markets

Hedging futures is an indispensable risk management strategy utilized by a wide range of market participants, including investors, businesses, and financial institutions. This strategy involves the use of futures contracts to mitigate potential losses resulting from price fluctuations in underlying assets. By employing this powerful tool, market participants can effectively lock in prices for future transactions, shielding themselves against adverse movements in the market. In this in-depth article, we will delve into the concept of hedging futures, its paramount importance, and the mechanics of how it operates.

Understanding Hedging Futures

Hedging futures can be succinctly defined as a form of financial derivative trading where two parties mutually agree to buy or sell an underlying asset at a predetermined price on a specified future date. These underlying assets can encompass a wide spectrum of options, ranging from tangible commodities such as gold, oil, and wheat to intangible financial instruments like stocks, currencies, or interest rates. By entering into these futures contracts, market participants aim to offset potential risks associated with fluctuations in the prices of these underlying assets.

Cannon Trading respects your privacy, all transactions are safe and secure with High-grade Encryption (AES-256, 256-bit keys). We do not sell your information to third parties.

The Role of Futures Brokers and Commodity Brokers

To engage in futures trading and effectively implement hedging strategies, market participants often rely on the expertise and services of futures brokers and commodity brokers. These professionals serve as intermediaries between buyers and sellers in the futures market, facilitating the execution of futures contracts. They provide valuable insights, execute orders on behalf of their clients, and ensure compliance with regulatory requirements. Futures brokers and commodity brokers play a pivotal role in assisting businesses and investors in managing their exposure to price volatility.

Importance of Hedging Futures

The primary purpose of hedging futures is to manage and mitigate risk effectively. In the complex landscape of financial markets, asset prices are subject to influence from a multitude of factors, including economic conditions, geopolitical events, supply and demand dynamics, and investor sentiment. These uncertainties can result in significant price swings, potentially leading to substantial losses for those exposed to these assets.

Hedging futures emerges as a powerful mechanism to counteract these risks. Consider, for example, producers of commodities like wheat or oil. They can secure their financial stability by locking in a future selling price through futures contracts, guaranteeing a predictable income even if market prices experience a decline. Conversely, consumers, such as airlines reliant on fuel, can employ futures contracts to shield themselves from potential spikes in oil prices by securing future purchases at fixed prices.

Investors in financial markets also widely adopt hedging futures. For instance, a portfolio manager who anticipates a potential downturn in the stock market can enter into futures contracts to sell stock index futures. In the event of a market decline, any losses incurred in the stock portfolio can be offset by gains in the futures position. This strategy acts as a safety net, providing investors with a means to safeguard their portfolios during challenging market conditions.

How Hedging Futures Works

To gain a comprehensive understanding of how hedging futures operate, let's explore an illustrative example. Imagine a jewelry manufacturer preparing to acquire a substantial amount of gold in six months to fulfill customer orders. However, the price of gold is highly volatile, and the manufacturer is apprehensive about a potential price increase, which could significantly impact their production costs and erode profit margins.

To hedge against this risk, the jewelry manufacturer can enter into a futures contract to purchase gold at a specified price in six months. This contract binds them to acquire gold at that price, irrespective of its market value at the specified future date. If the price of gold surges over the next six months, the jewelry manufacturer can still procure gold at the lower predetermined price, effectively avoiding the additional expenses and securing their profit margins.

It's crucial to note that while hedging futures can protect against unfavorable price movements, it simultaneously limits the potential for gains. If the market moves in favor of the hedger, they are obligated to adhere to the contract's terms and may miss out on the opportunity to capitalize on the price increase. However, for risk-averse participants whose primary objective is to protect against losses rather than maximize profits, hedging futures proves to be an invaluable strategy.

Conclusion:

In conclusion, hedging futures plays a vital role in managing risk in financial markets. It offers participants a means to safeguard themselves against price fluctuations in underlying assets, ensuring stability in their financial positions. Whether it's producers, consumers, investors, or financial institutions, hedging futures provides a powerful tool to secure their interests and navigate through uncertain market conditions. While it may limit potential gains, the peace of mind and protection it provides make hedging futures an indispensable strategy for prudent risk management in today's dynamic and volatile financial world.

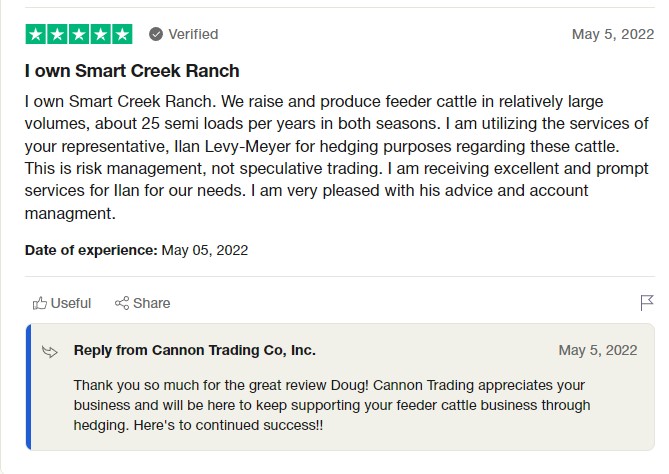

WHY CANNON?

(To be generated by our brokers onsite. We will get this to you as soon as possible).

The bottom of the page will include educational resource links from the CME Group provided to us. The links are below as follows:

- How to Hedge Grain Risk

- Livestock Hedging and Risk Management

- Self Study Guide to Hedging with Grain and Oil Seed

If you or your team have any questions regarding design and/or content, please reach out to me as soon as possible and I will get on a Skype with you. Ilan is out of the office for the week so please direct all design-related inquiries here.

Hedging Futures in Action: Real-World Scenarios

To underscore the practical significance of hedging futures, let's examine a few real-world scenarios where this strategy is commonly employed:

-

Agricultural Producers and Commodity Hedging:

Agricultural producers, such as farmers, face substantial uncertainty due to factors like weather conditions and market fluctuations. To safeguard their income and mitigate risk, they often use futures contracts to lock in prices for their crops or livestock well in advance. For instance, a wheat farmer may enter into a futures contract to sell a certain quantity of wheat at a predetermined price. This strategy allows them to secure a stable income, irrespective of fluctuations in wheat prices caused by factors like droughts or global demand.

-

Oil Companies and Energy Futures:

Oil companies are highly vulnerable to fluctuations in oil prices, which can significantly impact their profitability. To manage this risk, they utilize energy futures contracts to hedge against adverse price movements. By locking in prices for future oil deliveries, they can ensure a consistent revenue stream, even when market prices are volatile.

-

Importers and Currency Hedging:

Importers who conduct international trade often face currency exchange rate risk. To protect themselves from unfavorable currency movements, they use currency futures contracts to fix exchange rates for future transactions. This approach enables importers to calculate costs accurately and maintain profit margins, irrespective of fluctuating exchange rates.

-

Investment Portfolios and Portfolio Diversification:

Portfolio managers and investors employ hedging futures to diversify their investments and reduce overall portfolio risk. For instance, an investor with a substantial allocation to stocks may use stock index futures to hedge against potential market downturns. By doing so, they can offset losses in their stock holdings with gains in the futures position, thereby preserving the value of their portfolio.

Hedging futures stands as a cornerstone of risk management in financial markets. This strategy offers market participants a robust means to shield themselves against price fluctuations in underlying assets, thereby ensuring stability in their financial positions. Whether it's producers, consumers, investors, or financial institutions, hedging futures provides a powerful tool to safeguard their interests and navigate through uncertain market conditions.

While it may restrict the potential for gains, the peace of mind and protection it offers make hedging futures an indispensable strategy for prudent risk management in today's dynamic and volatile financial world. By collaborating with experienced futures brokers and commodity brokers, market participants can harness the full potential of hedging futures to secure their financial future and thrive in the ever- evolving landscape of global finance.

Disclaimer - Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.