Light Crude Oil Futures

Current Light Crude Oil Futures | Futures Prices

Light crude oil futures trading, dates back to the 1970's. Energy markets are relatively new compared to the more established commodities market. These took birth mainly to control the intrinsic volatile nature of the commodities market, and risk management. In addition, light crude oil futures trading is comparatively like apples to apples, to its predecessors that exist in the commodities market, they all rely on supply and demand.

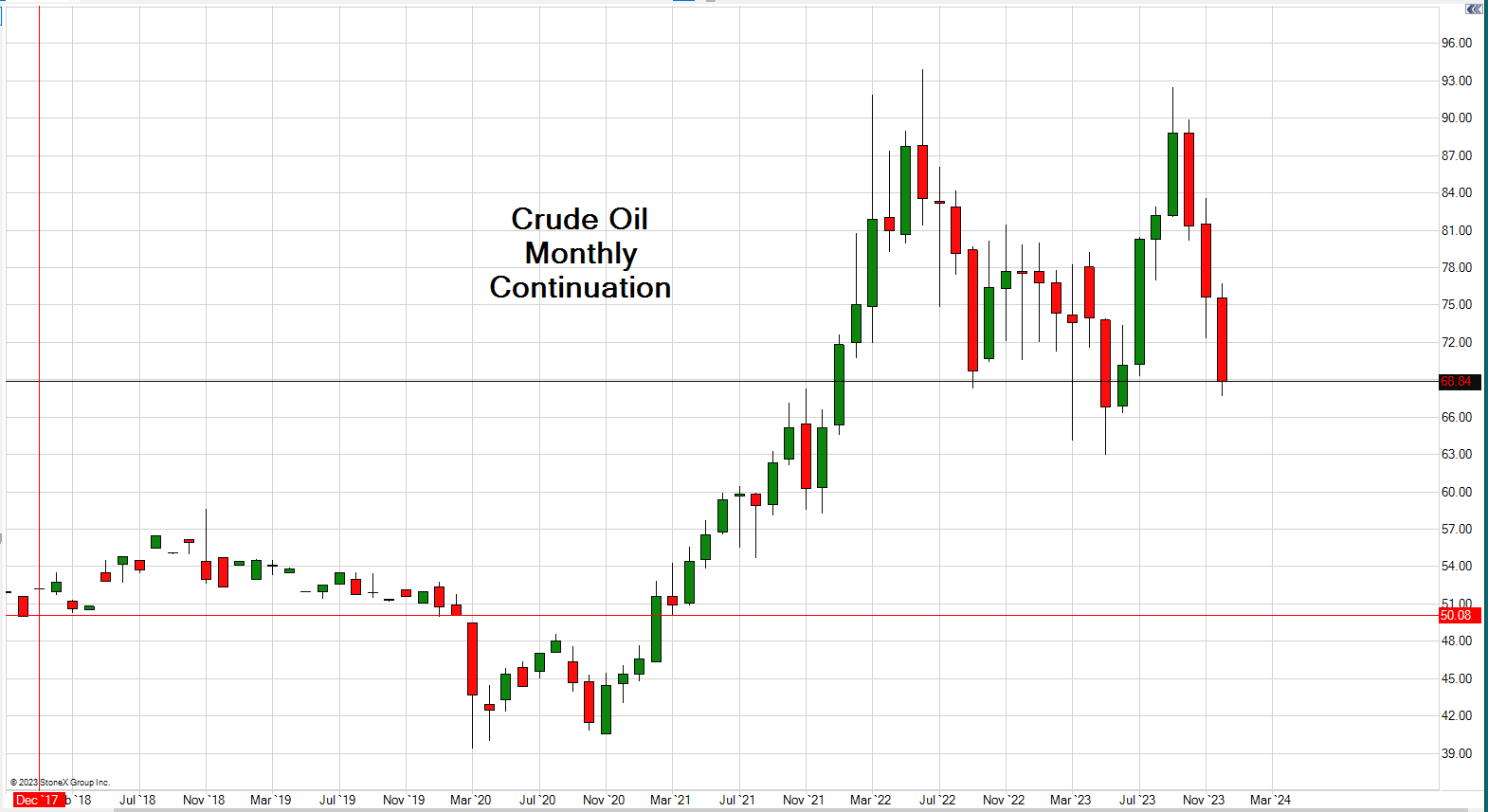

Light Crude Oil Futures Prices — Historical Chart

Chart of Light Crude Oil Futures Prices updated December 25th, 2023. Click the chart to enlarge. Press ESC to close.

Disclaimer: This material is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

Light Crude Oil Futures Contract Specifications

| Product Symbol | CL |

| Contract Size | 1,000 barrels |

| Price Quotation | U.S. Dollars and Cents per barrel |

| Venue | CME Globex, CME ClearPort, Open Outcry (New York) |

| CME Globex Hours (EST) | Sunday - Friday 6:00 p.m. - 5:15 p.m. New York time/ET (5:00 p.m. - 4:15 p.m. Chicago Time/CT) with a 45-minute break each day beginning at 5:15 p.m. (4:15 p.m. CT) |

| CME ClearPort Hours (EST) | Sunday - Friday 6:00 p.m. - 5:15 p.m. (5:00 p.m. - 4:15 p.m. Chicago Time/CT) with a 45-minute break each day beginning at 5:15 p.m. (4:15 p.m. CT) |

| Open Outcry Hours (EST) | Monday - Friday 9:00 AM to 2:30 PM (8:00 AM to 1:30 PM CT) |

| Minimum Fluctuation | $0.01 per barrel |

| Termination of Trading | Trading in the current delivery month shall cease on the third business day prior to the twenty-fifth calendar day of the month preceding the delivery month. If the twenty-fifth calendar day of the month is a non-business day, trading shall cease on the third business day prior to the last business day preceding the twenty-fifth calendar day. In the event that the official Exchange holiday schedule changes subsequent to the listing of a Crude Oil futures, the originally listed expiration date shall remain in effect. In the event that the originally listed expiration day is declared a holiday, expiration will move to the business day immediately prior. |

| Listed Contracts | Crude oil futures are listed nine years forward using the following listing schedule: consecutive months are listed for the current year and the next five years; in addition, the June and December contract months are listed beyond the sixth year. Additional months will be added on an annual basis after the December contract expires, so that an additional June and December contract would be added nine years forward, and the consecutive months in the sixth calendar year will be filled in. Additionally, trading can be executed at an average differential to the previous day's settlement prices for periods of two to 30 consecutive months in a single transaction. These calendar strips are executed during open outcry trading hours. |

| Settlement Type | Physical |

| Delivery | (A) Delivery shall be made F.O.B. at any pipeline or storage facility in

Cushing, Oklahoma with pipeline access to TEPPCO, Cushing storage or Equilon

Pipeline Company LLC Cushing storage. Delivery shall be made in accordance with

all applicable Federal executive orders and all applicable Federal, State and

local laws and regulations. For the purposes of this Rule, the term F.O.B. shall

mean a delivery in which the seller:

provides light "sweet" crude oil to the point of connection between seller's

incoming and buyer's outgoing pipeline or storage facility which is free of all

liens, encumbrances, unpaid taxes, fees and other charges; in the event of the

buyer's election to take delivery by interfacility transfer ("pump over") to

either TEPPCO, Cushing or Equilon Pipeline Company LLC, Cushing, from seller's

delivery facility, bears the lesser of the pump over charge applicable for

pump over from seller's delivery facility to TEPPCO or Equilon Pipeline Company

LLC; retains title to and bears the risk of loss for the product to the point of

connection between the buyer's outgoing and the seller's incoming pipeline or

storage facility.

(B) At buyer's option, such delivery shall be made by any of the

following methods:

By interfacility transfer ("pump over") into a designated pipeline or storage facility with access to seller's incoming pipeline or storage facility. By in-tank transfer of title to the buyer without physical movement of product; if the facility used by the seller allows such transfer, or by in-line transfer or book-out if the seller agrees to such transfer. (C) All deliveries made in accordance with these rules shall be final and there shall be no appeal. (D) Any seller delivering less than 5 contracts for one customer shall deliver out of storage at the Equilon Pipeline Company LLC facilities, unless the buyer and seller mutually agree to exempt the seller from this requirement. The seller shall provide preliminary confirmation of title transfer at the time of delivery by telex or other appropriate form of documentation. |

| Delivery Period | (A) Delivery shall take place no earlier than the first calendar day of

the delivery month and no later than the last calendar day of the delivery

month.

(B) It is the short's obligation to ensure that its crude oil receipts,

including each specific foreign crude oil stream, if applicable, are available

to begin flowing ratably in Cushing, Oklahoma by the first day of the delivery

month, in accord with generally accepted pipeline scheduling practices.

(C) Transfer of title-The seller shall give the buyer pipeline ticket,

any other quantitative certificates and all appropriate documents upon receipt

of payment.

The seller shall provide preliminary confirmation of title transfer at the time of delivery by telex or other appropriate form of documentation. |

| Grade and Quality Specifications | Please see rulebook chapter 200 |

| Exchange Rule | These contracts are listed with, and subject to, the rules and regulations of NYMEX. |

Free Demo Account

Free Demo Account

Index Futures

Energy Futures

Grain Futures

Financial Futures

Currency Futures

Agriculture Futures

MICRO Futures

Index futures

Micro e-mini ESMicro e-mini NQ

Micro e-mini Russell

Micro e-mini dow

Currency futures

Micro AUD/USDMicro EUR/USD

Micro GBP/USD

Micro USD/CHF

Energy futures

Micro Crude OilCrypto Currency futures

Micro BitcoinMicro Ether

Treasury futures

Micro Treasury YieldEUREX futures

Micro DAXOur Approach

You and your broker will work together to achieve your trading goals. We develop long term

relationships with our clients so that we can grow and improve together.

Learn More About Choosing Cannon

Our Platforms

Please click on one of our platforms below to learn more about them, start a free demo, or open

an account.

E-Futures

Firetip (Cannon Pro)

Trading Education

Recommended Resources

Guide to Risk and Opportunities of Futures and Options Trading

Steps to Successful Day-Trading

Day Trading Webinar